Planning for Wildlife Management

Texas landowners can maintain an ag tax valuation on land through wildlife management use. A landowner must file a 1-D-1 wildlife management plan with the county appraisal district to make the switch. This must be done in the calendar year when the land is converted from “regular” ag use to wildlife management use.

Wildlife management use involves actively managing the land for wildlife each year. Many wildlife and habitat practices allow a landowner to qualify. A 1-D-1 wildlife management plan containing the details of the practices carried out on the land is critical. This article discusses the ins and outs of 1-D-1 management plans. We also assist landowners with developing plans for their properties.

Steps to a 1-D-1 Wildlife Management Plan

There are logical steps involved when transitioning land from “regular” agricultural use to wildlife management use. It’s important to understand the process from beginning to end. In addition, it’s also important to know what wildlife management use actually involves. It’s also good to know what is expected of you. We will discuss this information and the necessary steps in detail.

7 Steps to Wildlife Management Use

- Landowner Interest

- Information Gathering

- Do You Qualify

- Identifying Management Practices

- Developing a 1-D-1 Management Plan

- Filing the Wildlife Management Plan

- Implementing Wildlife Practices

Step 1: Landowner Interest in 1-D-1

Landowners make the switch to wildlife use of their land for many reasons. Some landowners age out of agricultural activities. In these cases, a landowner switches from an income-based view of the land to simply maintaining an ag tax valuation. Likewise, the infrastructure of ag operations, such as fencing, corrals, and water development, are costly. Switching over to wildlife use saves the outlay of capital.

Some landowners inherit land. The land means a lot to them and they will never run an ag operation themselves. In these cases, maintaining a wildlife tax valuation on the land is a good alternative to traditional ag operations. It keeps the land in the family and can be used for recreation or to generate recreational income.

Similarly, some that inherited land have grown tired of an unresponsive leasee. A leasee may take advantage of the situation, abusing the land and/or making the landowner think that they need the leasee. After all, how can a landowner maintain a low ag tax rate without an ag operation? The answer: wildlife management use.

Lastly, many of the landowners converting land to wildlife management use just recently purchased land. The population of Texas is rapidly growing. In addition to organic growth, many people are moving into the state daily. Furthermore, many residents are looking to live outside of developed areas. Maybe they plan to commute, are retired, or plan to retire soon. All just want a place to where they can recreate, and an ag operation is not the priority.

Step 2: Gathering Info on Wildlife Tax Valuation

There is a saying about how if you are going to do something right, you need to do it right the first time. This is 100-percent true when it comes to putting together a 1-D-1 wildlife management plan. After all, there are tax dollars on the line! As it turns out, very few landowners are biologists. Most know very little about wildlife and habitat management practices, but love wildlife.

The process of gathering information about the wildlife tax valuation in Texas is how you ended up here. You are without a doubt on the right track. A good understanding of the ins and outs of wildlife management use will go a long way towards your success. In addition, an understanding of the process from beginning to end will ensure that it’s handed right from the start. We can help inform and execute on that front.

Step 3: Do You Qualify for 1-D-1? Minimum Acreage?

It’s important to determine from the start whether your property can qualify for 1-D-1 wildlife management use. No need developing a 1-D-1 wildlife management plan if it’s a no-go from the start. Fortunately, there are only a few key factors that determine whether your land is a candidate.

First, does the property have a current 1-D-1 agricultural tax valuation (appraisal)? If the answer is yes, then so far so good! If the answer is no, then your land can not be converted to wildlife use, unless an endangered species exists on the property.

Next, has the size of the tract of land been reduced in size during the year prior to the year in which you intend to apply for wildlife use? If the answer is no, then you have a clear path to 1-D-1 wildlife use on your land. If you answered yes, then the property is subject to the minimum acreage requirement. Your land may or may not be able to switch to wildlife management.

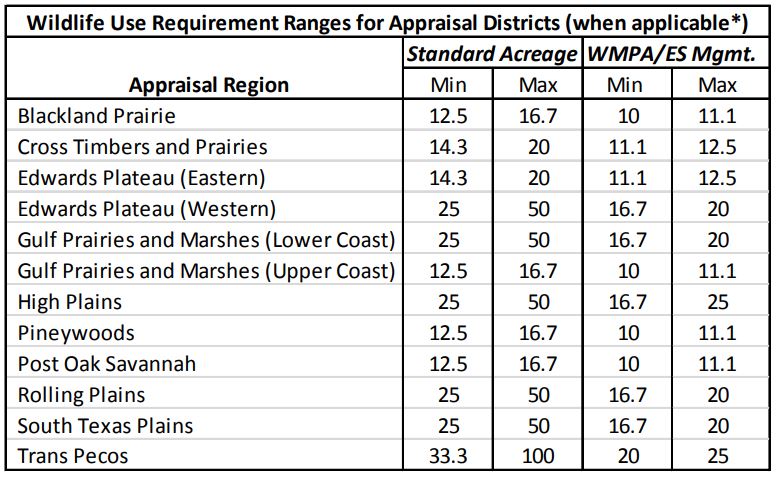

The acreage requirement for wildlife use varies by appraisal region, so please contact us and we can assist you in making this determination. In general, minimum acreage requirements range from about 12.5-50 acres for much of the state. These requirements generally increase from east to west within Texas.

Step 4: Identifying Management Practices

Once it’s been established that the property can transition to wildlife management use, the next step is identifying management activities. These activities must work for both the land and landowner. For wildlife management use, all wildlife and habitat management activities are divided among seven major management practices. A landowner must implement at least three of these seven practices on the property annually.

The seven 1-D-1 wildlife management practices include 1) Habitat Control, 2) Erosion Control, 3) Predator Control, 4) Provide Supplemental Water, 5) Provide Supplemental Food, 6) Provide Supplemental Shelters, and 7) Census (Wildlife Surveys).

We work with landowners to determine their interests and identify suitable wildlife to target for management on their land. This effort helps solve for two key components. First, that the selected activities meet the wildlife tax valuation guidelines for the ecoregion. And secondly, that the activities work for the landowner and are within their abilities.

Next, these activities and their intensity levels are detailed within a 1-D-1 wildlife management plan that we develop and write for the landowner. A strong, focused management plan is critical for success.

Step 5: Developing a 1-D-1 Wildlife Management Plan

A wildlife management plan is a written guide for how, when, and where to implement habitat improvement activities. A landowner is also required to file a 1-D-1 wildlife management plan when converting ag land to wildlife use appraisal. In general, developing a management plan for anything is a good idea. It’s an especially good idea when it comes to land management, as it will offer direction and save time and money.

Components of an effective 1-D-1 wildlife management plan includes land management goals and objectives, a simple habitat inventory, site specific habitat activities, a timeline for activities, and recommended record keeping. The last allows for evaluation of management efforts and their impacts on wildlife and habitat. It also helps with annual reporting, should the appraisal district ask for one.

A carefully developed management plan provides a logical approach for using an assortment of habitat improvement activities. Not everyone is familiar with wildlife management, so this task may seem daunting. This is especially true when one’s knowledge of the subject is thin and the future taxation of a property is on the line. We can help, saving both stress and time.

Step 6: Filing the Wildlife Management Plan

An important part of the 1-D-1 wildlife conversion process is filing your documents with the central appraisal district in the county where the land is located. Again, two documents are required when converting “regular” ag land to a wildlife tax valuation. A standard application for a change in land valuation must accompany the plan.

The filing process is straight forward. However, it’s important to note that some landowners forget to file for an agricultural tax valuation after purchasing agricultural land. A number of landowners have lost their ag tax valuation prior to contacting us. Unfortunately, as mentioned earlier, land must have an ag tax appraisal in order to convert to wildlife management use.

The time period for filing a change in land use in Texas is the same each year. Landowners can file documents from January 1 through April 30 in the year in which the change in use takes place. If converting from traditional ag use to wildlife management use in 2023, documents must be filed between Jan.1-April 30, 2023.

Step 7: Implementing Wildlife Practices on the Land

One of the final steps in maintaining wildlife management use appraisal on land is to implement at least three qualifying practices. Some activities may be carried out prior to filing documents with the appraisal district. Some activities may occur afterward and later in the year. It all depends on when the management activities need to take place within the year.

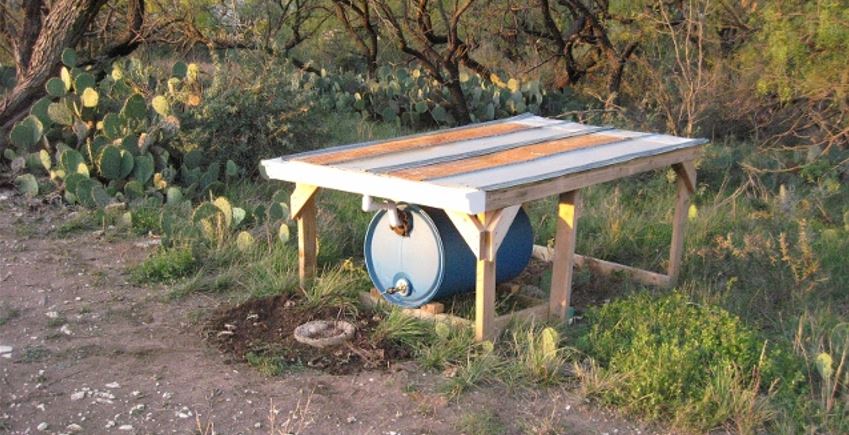

For example, installing a trough or rainwater collection system to provide supplemental water is a great management activity. We often recommend providing supplemental water for wildlife when surface water is not available on a tract of land. However, it would not make good sense to install a trough in December 2023 if a 1-D-1 wildlife management plan was filed in March 2023. Activities such as water trough installation need to happen immediately after filing, if not prior.

The same would hold true for nesting boxes setup for cavity nesting songbirds. For these structures to provide value for nesting birds, install them prior to the nesting season. On the other hand, if planting a fall food plot to provide supplemental food then the activity must take place later in the year.

Management activities such as brush management or predator control can take place throughout the year, for example. Some wildlife management activities have seasonal aspects to them, while others do not. In short, the implementation of specific management activities must make sense on an annual basis.

Review: 1-D-1 Wildlife Management Plan

In summary, landowners in Texas can can maintain an ag tax valuation on land through wildlife management use. Wildlife appraisal is an ag practice in Texas. A landowner must file a 1-D-1 wildlife management plan with the county appraisal district in the year the land use is converted. Landowners do not need to re-apply unless the land use changes.

Wildlife tax valuation involves actively managing the land for wildlife each year. Numerous wildlife and habitat practices allow a landowner to qualify. A 1-D-1 wildlife management plan that details at least three qualifying practices for at least one native wildlife species is required. We hope this article discussing wildlife use and management plans answered most of your tax valuation questions. There are a few parts to the process, but the results are healthy wildlife populations and landowners enjoying their land. Please contact us if you have additional questions or need assistance.